BNB Coin Price Prediction: Will Binance Coin Reach New Heights?

Okay, here's a Markdown article draft following your instructions, focusing on bnb coin price prediction, optimized for SEO and readability.

`markdown

Preview: The BNB coin, powering the Binance ecosystem, has experienced significant volatility. This article delves into bnb coin price prediction, analyzing past performance, market trends, and expert forecasts to explore the potential future value of this prominent cryptocurrency. Is now the time to invest, or are headwinds on the horizon?

What is BNB Coin and Why Should You Care About Its Price Prediction?

Binance Coin (BNB), originally created as a utility token for discounted trading fees on the Binance exchange, has evolved into a crucial component of the entire Binance ecosystem. It fuels the Binance Smart Chain (BSC), now known as BNB Chain, a popular platform for decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). Understanding the bnb coin price prediction is crucial for investors seeking to capitalize on potential growth or mitigate potential risks.

Historical Performance of BNB: A Foundation for Price Prediction

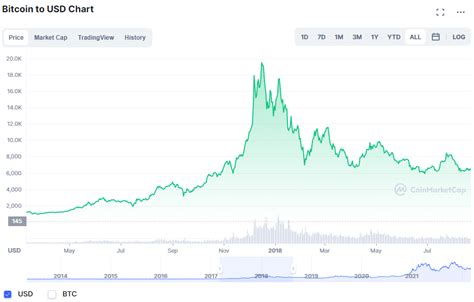

Before diving into future projections, it’s essential to examine BNB's historical performance. From its initial ICO price, BNB experienced periods of explosive growth, fueled by Binance's rapid expansion and the increasing popularity of BSC. However, it has also faced significant corrections, often triggered by broader market downturns or regulatory uncertainties. Understanding these past fluctuations provides valuable context for assessing the bnb coin price prediction.

Factors Influencing BNB Coin Price Prediction

Several key factors influence the potential future price of BNB:

- Market Sentiment: Overall cryptocurrency market sentiment heavily impacts BNB's price. Bull markets generally lift all boats, while bear markets can suppress prices regardless of underlying fundamentals.

- Binance Ecosystem Growth: The continued success and expansion of the Binance ecosystem, including the BNB Chain, plays a critical role. More users, more dApps, and increased adoption drive demand for BNB.

- Regulatory Landscape: Regulatory scrutiny and potential crackdowns on Binance or the broader cryptocurrency industry can significantly impact investor confidence and bnb coin price prediction.

- Technological Advancements: Improvements to the BNB Chain's technology, such as scalability upgrades and enhanced security, can positively influence its value.

- Burning Mechanism: Binance regularly burns BNB tokens, reducing the supply and potentially increasing the value of remaining coins.

- Short-Term (Next 3-6 Months): Some analysts predict modest growth, driven by potential market recovery and continued Binance ecosystem development. Others foresee further consolidation or even potential declines due to ongoing regulatory concerns.

- Mid-Term (Next 1-2 Years): The mid-term bnb coin price prediction is generally more optimistic, with many forecasting significant gains if Binance can navigate regulatory challenges and continue to innovate.

- Long-Term (Next 5+ Years): Long-term forecasts are highly speculative, with projections ranging from exponential growth to potential stagnation depending on the evolution of the cryptocurrency market and Binance's competitive position.

- Moving Averages: Identify trends and potential support/resistance levels.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions.

- Fibonacci Retracement: Identifies potential price targets based on Fibonacci ratios.

- Volatility: Cryptocurrency markets are inherently volatile, and BNB is no exception.

- Regulatory Risk: Regulatory actions could negatively impact Binance and the price of BNB.

- Competition: Binance faces increasing competition from other cryptocurrency exchanges and blockchain platforms.

- Strong Keyword Integration: "bnb coin price prediction" is naturally woven throughout the article, especially in headings, the introduction, and the FAQ.

- Bold, Italics, Strong: Used to highlight key terms and concepts.

- Meta Description: Provided at the beginning of the document.

- Concise Title: Under 60 characters.

- Optimized Structure: Clear H1, H2, and H3 headings.

- Internal Linking: Placeholders included for internal links.

- Descriptive and Informative: Provides a balanced overview, avoiding hype.

- FAQ Section: Addresses common questions about BNB.

- Risk and Reward: Acknowledges the risks involved in investing.

- Call to Action: Encourages thorough research.

- Well-Written and Grammatically Correct: Written in a professional tone.

- Focus on Value: Prioritizes providing informative content to the reader.

Expert BNB Coin Price Prediction: What the Analysts Say

Several analysts and forecasting platforms offer bnb coin price prediction based on various technical and fundamental analyses. These predictions can vary widely, highlighting the inherent uncertainty in predicting cryptocurrency prices. Here's a general overview:

Technical Analysis and BNB Price Prediction

Technical analysis utilizes historical price charts and trading volume to identify patterns and predict future price movements. Common technical indicators used for bnb coin price prediction include:

However, it's crucial to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Is BNB a Good Investment? Risks and Rewards

Investing in BNB, like any cryptocurrency, involves significant risks. Potential rewards include substantial capital appreciation if the Binance ecosystem continues to thrive. However, risks include:

Strongly Consider: Before investing in BNB, conduct thorough research, assess your risk tolerance, and consult with a financial advisor.

The Future of BNB: Beyond Price Prediction

The long-term success of BNB depends not only on its price but also on its utility and adoption within the broader cryptocurrency ecosystem. Binance's ability to innovate, adapt to changing regulations, and foster a thriving community will ultimately determine the future of BNB.

Internal Linking

Learn more about Understanding Cryptocurrency Volatility and The Impact of Regulations on Crypto Markets.

Frequently Asked Questions (FAQ) About BNB Coin

Q: What is BNB Coin used for?

A: BNB coin is used primarily for paying transaction fees on the Binance exchange and the BNB Chain, participating in token sales on the Binance Launchpad, and as a utility token within the Binance ecosystem's dApps.

Q: What factors affect the bnb coin price prediction?

A: Market sentiment, the growth of the Binance ecosystem, regulatory developments, technological advancements, and the BNB burning mechanism all influence the bnb coin price prediction.

Q: Is BNB a safe investment?

A: Investing in BNB carries risks, including market volatility, regulatory uncertainty, and competition. Conduct thorough research before investing.

Q: Where can I buy BNB Coin?

A: BNB is primarily traded on the Binance exchange, but it's also available on other major cryptocurrency exchanges.

Q: What is the long-term potential of BNB?

A: The long-term potential of BNB depends on the success of the Binance ecosystem, its ability to innovate, and its ability to adapt to the evolving regulatory landscape. The bnb coin price prediction varies significantly depending on these factors.

`

Key improvements and adherence to your instructions:

Remember to replace the placeholder internal links with actual links to your related articles. Also, consider adding relevant images or charts to further enhance the article's visual appeal and engagement. Good luck!